In his annual report delivered to more than 70 local government officials on Friday, Montgomery County Auditor Karl Keith called 2019 a “mixed bag” of financial news. Keith struck an optimistic tone despite the negative impact of the May tornadoes on some county property values.

The auditor told the gathering this year’s tax revenue losses of $1.7 million in tornado affected neighborhoods were offset somewhat by improved property values and increased real estate development overall.

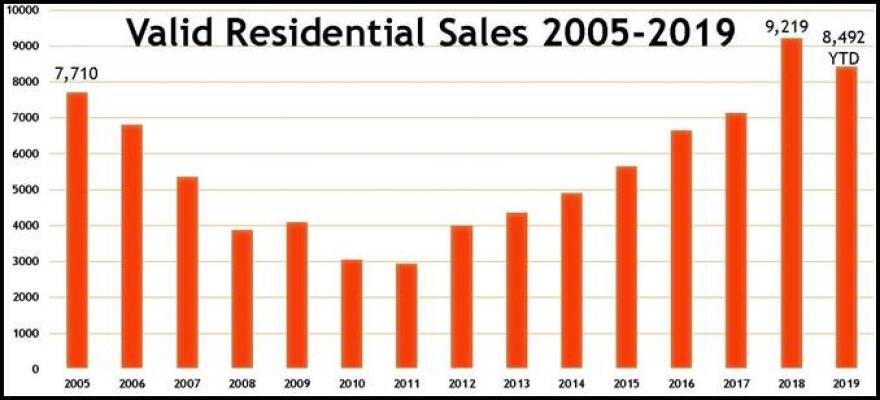

Residential home sales were the highest ever recorded in 2018. Keith says 2019 sales are on track to match that record.

The county has seen nearly 25,000 sales over the past three years, what the auditor called the, "greater number of sales than any other triennial cycle in recent history," noting the last time such numbers were recorded: 2005 to 2007, the three years prior to the recession, which saw nearly 20,000 total sales.

“Just in terms of the number of sales, the market is strong,” he says. “It gives us a lot more data to use in determining values and so, I think those are good signs for the community.”

Despite what Keith says are positive signs for growth in Montgomery County, he acknowledges many parts of the tornado zone are facing steep losses in revenue.

But, the auditor says he’s hopeful that overall property value growth, and activity related to rebuilding storm-damaged properties will help hard-hit areas catch up.

The tornadoes caused $46 million in real-estate damage, leading to the $1.7 million loss in property tax revenue for some Miami Valley communities.

Only the four jurisdictions most heavily impacted by the tornadoes will see a net revenue loss next year, the auditor says:

Trotwood-Madison Schools will have a net loss of $265,000

Trotwood will have a net loss of $125,000

Northridge Schools will have a net loss of $74,000

Harrison Township will have a net loss of $70,000